All Categories

Featured

Table of Contents

Some trading systems bill fees on purchases, such as moving funds and taking out money. These charges can differ, depending on the size of the deal and overall trading volume. You can wind up paying a high rate to access your possessions when you require them one of the most. Regardless of their misleading name, stablecoins use no guarantee of protection versus shedding worth.

Worth in cryptocurrencies and various other digital assets might be propped up by automated trading. Robots could be configured to identify when an additional investor is attempting to make a purchase, and acquire prior to the investor can finish their purchase. This technique can raise the rate of the virtual property and price you more to purchase it.

Their monetary interests may conflict with yours for instance, if they deal to enhance themselves and ruin you. On top of that, some large financiers get beneficial treatment, such as exclusive cash-outs that are unnoticeable to the public.: There are no federally regulated exchanges, like the New York Supply Exchange or Nasdaq, for virtual money.

How To Invest In Bitcoin And Altcoins Safely

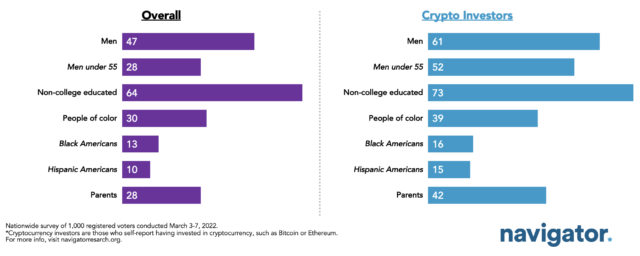

CHICAGO, July 22, 2021 Thirteen percent of Americans evaluated report getting or trading cryptocurrencies in the past twelve month, according to a brand-new survey conducted by NORC at the University of Chicago. This number is slightly over half of that of survey participants who reported trading supplies (24 percent) over the exact same period.

Two-fifths of crypto traders are not white (44 percent), and 41 percent are females. Over one-third (35 percent) have household revenues under $60k every year. "Cryptocurrencies are opening up investing possibilities for more varied capitalists, which is an excellent thing," says Angela Fontes, a vice president in the Economics, Justice, and Society division at NORC at the University of Chicago.

The Role Of Stablecoins In The Crypto Market

Other U.S. regulators that might have jurisdiction over crypto, depending upon the certain usage, consist of the united state Stocks and Exchange Compensation (SEC), the Internal Profits Service (IRS), the Federal Profession Payment (FTC) and the Workplace of the Comptroller of the Currency (OCC), to name a few. Crypto financial investments are treated as home by the IRS and tired accordingly.

Stablecoins are not currently regulated. Legislation was introduced in 2022 that, if passed, would manage and accept stablecoins as a main component of the united state economic and banking system. NFTs are electronic assets that stay as code on a blockchainoften, but not exclusively, on the ethereum blockchain. When you purchase an NFT, you get ownership of that particular little alphanumeric code, associated with whatever has been tokenized.

Furthermore, once that token is transferred to a purchaser, ownership of that work is likewise moved. This doesn't imply, nevertheless, that an NFT owner especially inherits the copyright to the asset. NFTs may also be gone along with by a "smart agreement," which places problems on a token-holder's civil liberties. The settlement of royalties to the initial NFT maker may be component of a clever contract.

This includes discussion over whether an NFT is a safety and security. A coin or token offering is a method for developers of a digital currency to elevate cash. Offerings come in various formats and may be offered openly, privately or both. Right here are some examples: In an ICO, a business provides digital symbols offer for sale straight to financiers to fund a particular project or system and disperses the tokens through a blockchain network.

Blockchain Use Cases Beyond Cryptocurrency

An STO is similar to an ICO however should adhere to laws and guidelines in the nation and state where the token is being provided. Unlike digital coins or tokens with ICOs and IEOs, safety or equity tokens are utilized to raise funding and represent a risk in an exterior asset such as equity, financial obligation or a commodity such as crude oil.

:max_bytes(150000):strip_icc()/how-to-invest-in-bitcoin-391272-final-c7c727744bf44df08ac11afb5fb64fe3.jpg)

Possession of security tokens is recorded on an immutable blockchain ledger. Coin offerings usually require specialized technology proficiency to comprehend and evaluate. Capitalists must examine all matching information, including the internet site and white paper. This informationwhich explains the group, the task concept and implementation strategy, intended goals, and moremight be extremely technical, difficult to confirm or misleading and could even include fraudulent info.

Others will certainly not or will certainly require alterations to address variables ranging from legal choices and regulatory frameworks to technology advancements, expenses and consumer demand. In the united state, if a coin or token offering is a safety, or represents itself to be a safety, it has to be registered with the SEC or get an exemption from enrollment.

Why Crypto Prices Are So Volatile

Coin and token offerings outside of the U (Yield Farming).S. may or may not be signed up. No matter regulation condition, fraudulence and rate adjustment can still take place. An additional way to acquire exposure to the electronic property industry is to acquire protections in public companies that are involved in related economic modern technology, or fintech, sectors, or funds made up of such companies

Self-awareness is critical in investing, specifically in crypto. By comprehending the sort of investor that you are, you can choose a financial investment approach that matches your goals and run the risk of resistance. While no archetype is ever before an ideal suit, these financier types can help you determine some tools that are particularly useful to you.

The Novice The Bitcoin Maximalist The HODLer The Trader The FOMOer The Seeker The Standard Financier The Ecosystem Expert The Crypto Indigenous The Early Adopter The Whale Have a look at the summary and qualities of each investor type and see which one matches you the most effective. Then, when you have actually discovered your type, have a look at the devices that similar investors make use of to make smarter choices.

While the very first step can be the hardest, it's the most important. The good news is, this beginner's guide to constructing a successful crypto portfolio will help make it as easy as possible. Traits of a novice: Intrigued in crypto yet uncertain where to start. Wanting to boost their riches, and their understanding.

Comparing Crypto Trading Bots For Beginners

Tools that can help a novice: While the crypto community is developing lots of interesting innovations, bitcoin maximalists take into consideration the safe and secure, audio money of bitcoin to be the most important. Influenced by the brilliance of the blockchain and Satoshi's innovation, they came for the modern technology, however stay for the revolution. Traits of a bitcoin maximalist: Purchases every dip.

Satoshi is their hero. Tools that can aid a bitcoin maximalist: The HODLer can enjoy the worth of his coins double in a month or dip 30% in a day and never even think regarding marketing. Well, they might consider selling, but they have the self-control to maintain HODLing through the highs and the lows.

Tools that can aid a trader: FOMO is the Anxiety Of Missing Out. It's a psychological state that's all also simple to yield too, especially as costs increase and produce crypto millionaires over night.

Latest Posts

How To Diversify Your Crypto Portfolio

The Impact Of Bitcoin Halving On The Market

The Role Of Stablecoins In The Crypto Market